Don’t panic, plan: dealing with the COVID-19 financial downturn

When you’re watching the numbers tumble ever downwards seemingly without end, and the media is full of predictions of financial meltdown and doom, it can be easy to panic. Especially if those numbers you’re watching represent the diminishing value of your investments. The first instinct of many people is to cut their losses and sell without delay. But is this a wise course of action? Or is there an alternative strategy? Let’s take a look…

Along came COVID

The paragraph you’ve just read isn’t a fictional scenario. It’s based on the experiences of many investors who will recently have looked at their portfolios in dismay following one of the most turbulent H1’s in history. That turbulence, of course, being caused by the first pandemic in a century; COVID-19, which shut down entire economies, closed borders and tipped the markets into disarray.

As markets began to get wind of the seriousness of the COVID-19 pandemic, declines accelerated through March, causing the panic selling of everything from equities and bonds through to commodities such as oil, gold and ores. Many private investors followed along, succumbing to loss aversion, and liquidating their positions.

But there’s an alternative strategy. And, it’s a strategy which, if one looks to economic history, has often proved to be very successful.

Don’t let a bear (market) scare you

There are major two factors to bear in mind (no pun intended) when deciding whether or not to hold your position during a bear market.

Firstly, bear markets tend to be much shorter than bull markets, with some studies suggesting that the average duration of a bear market is less than one-fifth of the average bull market. Yes, it’s certainly painful to watch the value of your investments plummet, but as repeated bear and bull markets have shown, if you hold your position you will eventually recover the value of your assets.

Secondly, not only are bear markets usually a short, sharp, shock, but stocks usually revert back to gaining value. Since the 1920s, stocks have risen on average over any ten-year period. In other words, hold on to your stocks long enough and you’ll not merely recover your lost value, but increase it.

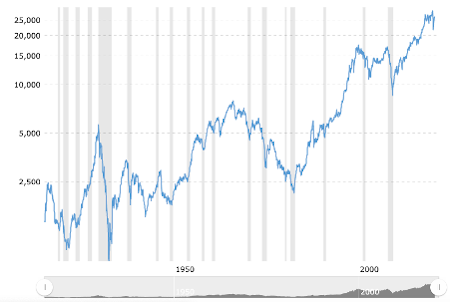

(Over a long enough timeline stocks will re-coup their value. Pictured here is the Dow Jones Industrial Average (DJIA) stock market index for the last 100 years. Historical data is inflation-adjusted. Graph via macrotrends.net).

Unfortunately, whilst these two points may seem like common sense, the psychology of many investors actively fights against these propositions. Linear extrapolation is a psychological phenomenon which means we typically think in ‘straight lines’. When something is going up, our instinct tells us it’s going to keep going up. The same goes for scenarios in which something is going down. Searching for straight lines on market charts is a folly, however. Markets have never moved in a straight line and are instead cyclical. Don’t let these psychological biases lead you astray.

Remember, don’t panic, and hold on.

Don’t try and time it

Which brings us to our next observation…

Some investors engage in market timing; moving in and out of financial markets or switching between asset classes based on predictive methodologies. However, attempting to time the market – especially over the long run – is very difficult to do successfully. Indeed, many commentators, academics and financial professionals insist that market timing is impossible.

Instead, many of these professionals recommend a buy-and-hold strategy, even during bear markets.

The historical evidence bears this out. According to J.P. Morgan’s Asset Management’s Guide to Retirement, an investor with $10,000 in the S&P 500 index who maintained their position between 1999 and 2018 would now have approximately $30,000. “An investor who missed 10 of the best days in the market each year would have under $15,000”. To emphasise the risk associated with a market timing strategy, the report states that, “A very skittish investor who missed 30 of the best days, would have less than what he or she started with – around $6,213 to be exact.”

(Pictured here is a 90-year historical chart of the S&P 500 stock market index. Historical data is inflation adjusted. Graph via macrotrends.net).

As the example above shows, it is those investors who are able to maintain discipline, even during the very worst bear markets, who will ultimately be better off.

No matter what predictive methodologies and technologies crop-up, it will be unlikely they will ever match the (albeit long-term) success of buy-and-hold strategies. As Ben Carlson says in A Wealth of Common Sense:

“Individuals have to understand that no matter what innovations we see in the financial industry, patience will always be the great equaliser in financial markets. There’s no way to arbitrage good behaviour over a long-time horizon. In fact, one of the biggest advantages individuals have over the pros is the ability to be patient.”

Accumulate now

Contrary to what your instincts and gut feeling may be telling you, the depths of a bear market or downturn can be the best time to accumulate further stocks. It’s a strategy which is pithily summed up by one of the world’s most successful investors, Warren Buffet:

“Be fearful when others are greedy, and greedy when others are fearful.”

Many investors will be using the current market downturn as an opportunity to buy up stocks at bargain prices. As Buffet has also said (writing in the New York Times in the midst of the 2008 financial crash):

“If you have cash to invest in stocks, the best time to do it is when everyone else thinks the world is about to end. If you don’t have cash and you don’t need any immediately to pay off bills, don’t sell your stocks. Even people close to or in retirement may be able to wait a few years to see their investments return.”

Naturally, investors shouldn’t be buying any or every stock that appears to be a bargain. Wise investors are rightly wary of highly leveraged entities or businesses that are in weak competitive/trading positions. Equally, the latest financial downturn could well prove to be an existential blow to companies which were already in declining markets such as high street retail, hydrocarbon extraction and production and others. Meanwhile equities and bonds that meet ESG (Environmental, Social and Governance) criteria appear to be outperforming the wider market (according to a June 2020 Morning Star study of the long-term performance of 745 Europe-based sustainable funds) and will be on many investor shopping lists.

Have a plan (and stick to it)

It sounds like common sense. But like so many things that should be common sense, having a long-term investment plan that’s aligned to your goals and a sound investment strategy, is not something that every investor has (or sticks to).

But you can be different.

Sound, long-term investors are working with a 20- or 30-year investment time horizon. For these investors, stock market crashes like those of 2008, the post-Brexit turndown and the current COVID-19 shock are but blips, with the value of their holdings re-couped over time. On the other hand, investors that have pulled their money in a reactive way to these events will have found that their losses have crystallised over the long term. As discussed above, there’s only one winner between those two investors.

In addition to having a long-term buy-and-hold investment strategy, savvy investors are using the current situation as an opportunity to diversify their portfolios, strengthening their asset base further with a mix of asset classes to protect against future market turbulence.

So, be patient, be intelligent, and you’ll emerge from the current COVID-19 market downturn set-up for success.

As the headline of this article states, don’t panic, plan…

Choose an independent investment management service

Choose Blankstone Sington. If you’re a private investor seeking the type of bespoke portfolio construction and management that will deliver long-term results, speak to us today or read more about our services here.

This article does not constitute personal advice. If you are in doubt as to the suitability of an investment, please contact one of our advisors. Past performance is not a reliable indicator of the future. The value of your investment can go down as well as up, and you can get back less than you originally invested.